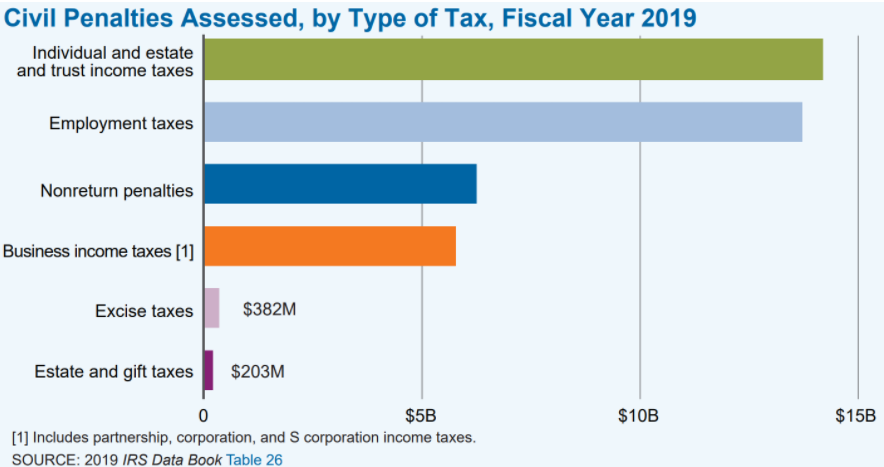

Every year, the IRS charges tax debtors a boat load of penalties.

Just how much? If you’re in and you owe taxes, you should definitely take a look…

To put this in perspective, the IRS budget for 2021 is about $12 billion. That means the entirety of IRS operations could be funded this year with just the money they charge individuals or small businesses in penalties. This includes people in who find themselves owing the IRS.

When you’re on the receiving end of these penalties, it can feel like the IRS is just pouring salt into the wound. When you can’t pay your taxes, the last thing you want to see is…more taxes. Fortunately, the IRS does provide several options for penalty relief.

First Time Abate

If you or anyone you know in are eligible, the IRS has a fairly simple administrative procedure for penalty relief:

Failure to file a tax return

Failure to pay taxes by the time they were due

Failure to deposit payroll taxes in a timely manner

In order to receive penalty relief under this program, you can’t have any unfiled returns. In other words, you need to have a clean filing history. If you’ve skipped filing a tax return in recent years, you’ll need to get caught up on those filings in order to be eligible for penalty relief. For your tax return, filing an extension request is perfectly fine and counts toward eligibility for this program. Also, if the IRS has been kind enough to file a tax return for you, this doesn’t count. So, you’ll need to file an actual tax return to replace the one the IRS prepared (which is fine because those are almost always wrong anyway and definitely not in your favor).

On top of that, you need to take the necessary steps to deal with the unpaid tax debt. For you or filers in the same situation as you to be eligible for penalty relief, you either need to pay off the tax liability or enter into a payment plan. If you’re in a tough spot and can’t afford to make monthly payments on the tax debt, the IRS can put you into a special non-collectible status. The drawback of this is that it makes you ineligible for the removal of penalties.

This administrative waiver of penalties is something you or taxpayers like you can get every few years. The IRS insists that you have a clean record with them for at least the three years prior to the year that you are requesting penalty relief for. For example, if you filed your tax return late and got penalized for it, the IRS will only waive those penalties if you were penalty-free in the previous three years. So, while this program is called a “first time” abate, what it really means is “first time after three years.”

Due to this three year rule, when you owe taxes for multiple years, and thus have several years in a row of penalties, you’re only allowed penalty relief for the first year in the sequence. For example, if you owed taxes and filed late for 2016 through 2019, at best you’re only going to be eligible for penalty reduction on that 2016 tax debt.

Reasonable Cause Penalty Relief

The First Time Abate program is a very structured rule. You’re either eligible for it…or you’re not. However, the IRS understands that things aren’t always that straightforward for people all across the country including those in .

If you have a reasonable excuse for why you didn’t file a tax return or pay your taxes on time, the IRS will consider it. Something for you or anyone you know in that owes taxes to keep in mind. Still, they have specific rules for how they evaluate those kinds of requests, and decisions are made on a case-by-case basis.

What the IRS is looking for in order to give penalty relief in these situations is proof that you make reasonable efforts to comply with the tax laws, but just weren’t able to because of circumstances beyond your control. For example, it’s really hard to file your own tax return if you’re dead. Sounds ridiculous, right? But you’d be surprised at some of the things I’ve seen!

Consider these questions to figure out if circumstances were “beyond your control”:

- Were you or a family member seriously ill?

- Did you experience the death of a loved one?

- Was there a natural disaster that affected your local area?

- Did you experience identity theft?

- Were there drug, alcohol, gambling, or other addiction issues?

If you or somebody in your immediate family (or anyone you know in ) experienced any of these types of issues, then you might be able to make a case for reasonable cause penalty abatement. If any of these were your situation, you and I will need to have a potentially difficult-for-you conversation, so I can try to connect the dots between your circumstance and your failure to file or pay taxes.

Offer in Compromise

Very few people ever qualify for this one, so I’m hesitant to even mention it. This is the proverbial “pennies on the dollar” settlement you may have heard rumors about. It does, in fact, exist, but there are very strict eligibility criteria for it. For example, in 2019 the IRS accepted less than 18,000 of these reduced settlements…nationwide.

Still, here’s why I mention it: If you’re eligible, all of the penalties and interest the IRS has charged you magically disappear. That’s right…ALL of them.

No explanation required. No excuses to be made.

If you are in such dire straits financially that you qualify for this program, then your entire tax debt is simply erased, penalties and all. That’s some potentially exciting news on the penalty relief front for taxpayers who find themselves on the wrong side of the IRS.

Still, with all these rules and special requirements, this is clearly not something you should tackle yourself. If you owe back taxes to the IRS, you undoubtedly have penalties, too.

We’re in your corner…

Warmly,

T. Gregory Talbott

888-339-4914

Strategic Tax Resolution LLC